Ulcer Performance Index

Introduction

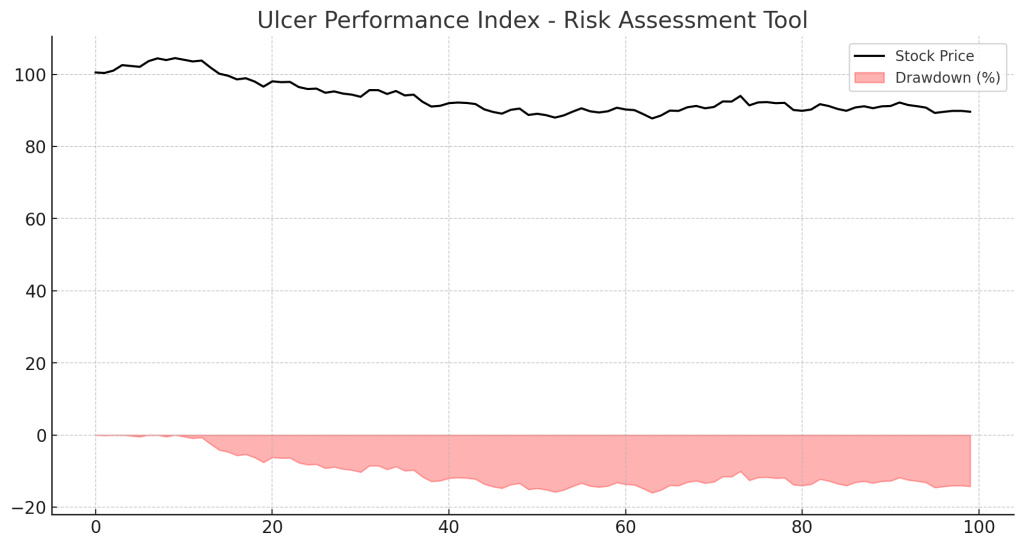

The Ulcer Performance Index (UPI) is a financial metric that evaluates an investment’s risk-adjusted return by focusing on drawdowns rather than volatility. It helps traders and investors measure how well an asset recovers from declines, making it particularly useful for risk-sensitive strategies.

What is the Ulcer Performance Index?

The UPI is based on the Ulcer Index (UI), which quantifies the depth and duration of price declines. Unlike traditional volatility measures like standard deviation, UPI prioritizes downside risk, providing a clearer picture of an asset’s stability.

The formula for UPI is:

Where:

- Annualized Return = Compound annual growth rate (CAGR) of the investment.

- Ulcer Index (UI) = Square root of the average squared drawdowns.

How to Interpret Ulcer Performance Index

- Higher UPI: Indicates better risk-adjusted returns with lower drawdowns.

- Lower UPI: Suggests higher risk relative to the returns.

- UPI vs. Sharpe Ratio: Unlike the Sharpe Ratio, which considers both upside and downside volatility, UPI focuses only on downside risk.

Trading Strategies Using Ulcer Performance Index

1. Portfolio Risk Management

- Investors use UPI to select assets with high returns and low drawdowns.

- Assets with consistent growth and minimal declines have a higher UPI.

2. Comparing Investment Strategies

- Momentum traders prefer assets with high UPI, ensuring sustained trends.

- Value investors use UPI to compare stocks with stable performance.

3. Long-Term Investment Selection

- UPI helps in identifying steady-performing assets for long-term growth.

- Mutual funds and ETFs with higher UPI indicate better downside protection.

Example of Ulcer Performance Index in Action

- Suppose two funds generate a 10% return annually:

- Fund A has smaller and shorter drawdowns, resulting in a high UPI.

- Fund B experiences frequent deep drawdowns, leading to a low UPI.

- An investor seeking lower downside risk would prefer Fund A based on its UPI.

Advantages of the Ulcer Performance Index

- Better Risk Assessment: Focuses on downside risk rather than total volatility.

- Improves Portfolio Selection: Helps in identifying investments with stable performance.

- More Reliable than Standard Deviation: Provides a clearer view of market drawdowns in the UPI.

Limitations

- Best for Long-Term Investments: Less effective for short-term or high-frequency trading.

- Requires Historical Data: More useful for assets with extended price history, benefitting UPI analysis.

Conclusion

The UPI is a valuable tool for measuring risk-adjusted returns, prioritizing drawdowns over traditional volatility metrics. By incorporating the UPI into investment analysis, traders and investors can make informed decisions that align with their risk tolerance.