Monthly Stock Charts: A Long-Term Perspective on Market Trends

Introduction

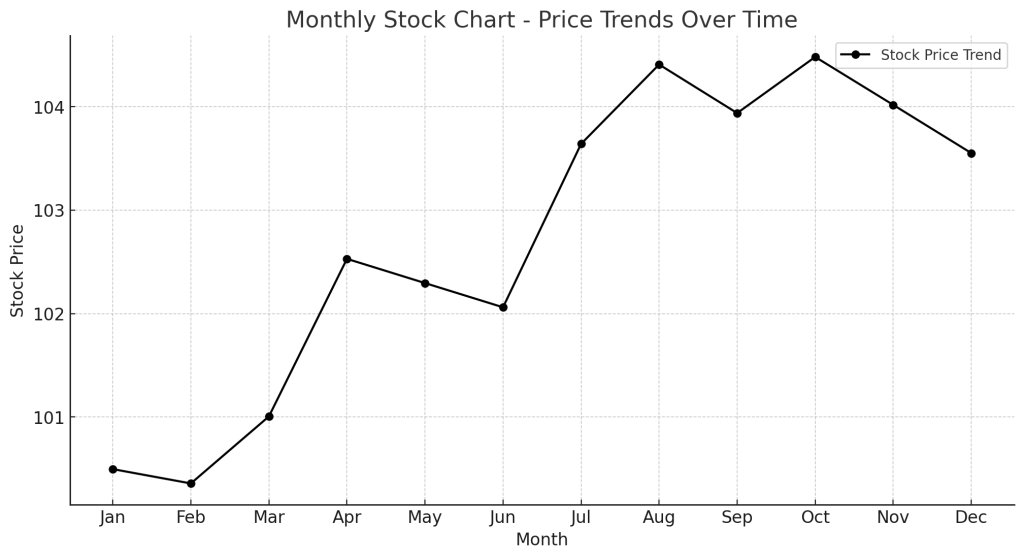

Monthly Stock Charts are essential tools for traders and investors who focus on long-term trends and price movements. These charts provide a broader market perspective by displaying monthly closing prices, making them ideal for trend analysis, portfolio management, and strategic trading decisions.

What is a Monthly Stock Chart?

A Monthly Stock Chart represents the historical price movement of a stock, index, or financial asset over one-month intervals. Unlike daily or intraday charts, monthly charts smooth out short-term fluctuations, making them valuable for identifying major trends.

Key Components of a Monthly Stock Chart

- Price Data: The stock’s monthly open, high, low, and close (OHLC) prices.

- Trendlines: Help identify bullish and bearish trends over time.

- Moving Averages:

- 50-Month Moving Average (Medium-Term): Identifies price direction.

- 200-Month Moving Average (Long-Term): Confirms major market trends.

- Volume Analysis: Measures buying and selling activity within each month.

How to Interpret a Monthly Stock Chart

- Identifying Trends:

- Uptrend: Higher highs and higher lows over multiple months.

- Downtrend: Lower highs and lower lows indicating weakness.

- Sideways Movement: Consolidation phase before a breakout.

- Using Moving Averages:

- If the price is above the 50-month moving average, it signals a bullish trend.

- If the price is below the 200-month moving average, it suggests a bearish trend.

- Breakout and Reversal Patterns:

- Bullish Breakout: Price breaks above a previous resistance level.

- Bearish Reversal: Price falls below a key support level.

Trading Strategies Using Monthly Stock Charts

1. Trend Following Strategy

- Identify stocks in a long-term uptrend using moving averages.

- Buy on pullbacks to the 50-month moving average.

2. Support & Resistance Trading

- Identify long-term support and resistance zones.

- Buy near strong support and sell near major resistance.

3. Volume Confirmation Strategy

- Look for high volume during breakouts or trend reversals.

- High volume confirms institutional interest and trend strength.

Example of a Monthly Stock Chart Trade

- A stock has been trending above the 50-month moving average for the last 12 months.

- The price breaks above a key resistance level, confirming a bullish continuation.

- A trader enters a long position, targeting the next major resistance zone.

Advantages of Using Monthly Stock Charts

- Reduces Market Noise: Filters out short-term fluctuations for a clearer trend.

- Ideal for Long-Term Investors: Helps identify stable stocks for buy-and-hold strategies.

- Works Across Multiple Asset Classes: Useful for stocks, commodities, forex, and indices.

Limitations

- Not Suitable for Short-Term Traders: Monthly charts are not ideal for intraday or swing trading.

- Late Entry in Trend Changes: Signals take longer to develop compared to daily charts.

Conclusion

The Monthly Stock Chart is an invaluable tool for investors and traders focusing on long-term market trends. By using moving averages, trendlines, and volume analysis, traders can make informed decisions with a broader market outlook.