McClellan Oscillator: A Momentum Indicator for Market Breadth Analysis

Introduction

The McClellan Oscillator is a market breadth momentum indicator that helps traders assess the strength of market trends and potential reversals. It is derived from the Advance-Decline Line, which measures the difference between advancing and declining stocks.

What is the McClellan Oscillator?

The McClellan Oscillator is calculated using Exponential Moving Averages (EMAs) of the Advancing-Declining Issues (A-D Line) to track market momentum.

Formula for McClellan Oscillator:

Where:

- Advances = Number of stocks that closed higher than the previous day.

- Declines = Number of stocks that closed lower than the previous day.

- 19-day EMA = Short-term trend strength.

- 39-day EMA = Long-term trend strength.

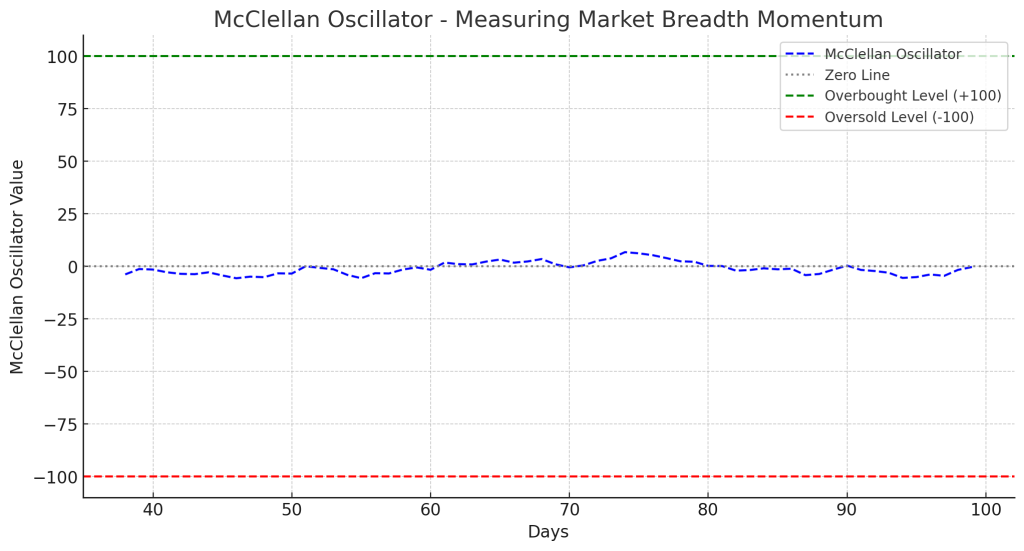

How to Interpret the McClellan Oscillator

- Positive Values (> 0):

- Indicates bullish momentum.

- The market is experiencing strong breadth and participation.

- Negative Values (< 0):

- Indicates bearish momentum.

- More declining stocks suggest weak market breadth.

- Overbought & Oversold Levels:

- Above +100: Overbought market → Possible trend reversal downward.

- Below -100: Oversold market → Potential bullish rebound.

- Divergence Signals:

- Bullish Divergence: Market index forms lower lows, but the McClellan Oscillator forms higher lows → Possible reversal upwards.

- Bearish Divergence: Market index forms higher highs, but the McClellan Oscillator forms lower highs → Possible reversal downwards.

Trading Strategies Using McClellan Oscillator

1. Trend Confirmation Strategy

- Bullish signal: Enter long positions when the McClellan Oscillator crosses above zero.

- Bearish signal: Enter short positions when the McClellan Oscillator crosses below zero.

2. Overbought/Oversold Strategy

- If the McClellan Oscillator is above +100, consider taking profits or preparing for a reversal.

- If the McClellan Oscillator is below -100, look for potential buy opportunities.

3. Divergence Trading Strategy

- Buy when the McClellan Oscillator shows bullish divergence (higher lows while price falls).

- Sell when the McClellan Oscillator shows bearish divergence (lower highs while price rises).

Example of a McClellan Oscillator Trade

- The S&P 500 is making new highs, but the McClellan Oscillator is declining.

- This bearish divergence signals weakening momentum.

- A trader exits long positions and prepares for a potential sell-off.

Advantages of Using the McClellan Oscillator

- Confirms Market Momentum: Helps traders assess whether trends are sustainable.

- Filters False Breakouts: Avoids misleading signals by measuring market breadth.

- Effective for Index Trading: Works well with S&P 500, NASDAQ, and NYSE Composite.

Limitations

- Lagging Indicator: Uses moving averages, which can delay signals.

- Works Best in Trending Markets: Less effective in choppy or sideways conditions.

Conclusion

The McClellan Oscillator is a valuable momentum indicator that helps traders analyze market breadth and trend strength. By combining it with support/resistance levels, moving averages, and volume analysis, traders can improve accuracy and identify trend reversals early.