Hull Moving Average (HMA): A Smoother Trend-Following Indicator

Introduction

The Hull Moving Average (HMA) is an advanced trend-following indicator designed to minimize lag while maintaining smooth price action. Developed by Alan Hull, the HMA improves upon traditional moving averages by reducing noise and improving trend accuracy.

What is the Hull Moving Average (HMA)?

The HMA is a modified weighted moving average (WMA) that adjusts to market conditions, making it faster and more responsive than the Simple Moving Average (SMA) or Exponential Moving Average (EMA). It’s important to understand how the Hull Moving Average can adapt to such conditions.

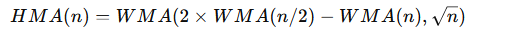

HMA Average Formula:

Where:

- WMA = Weighted Moving Average

- n = Period length

How to Use the HMA Indicator

- Trend Identification:

- Uptrend: HMA slopes upward → Bullish market.

- Downtrend: HMA slopes downward → Bearish market.

- Entry and Exit Signals:

- Buy Signal: When the HMA turns upward from a downtrend.

- Sell Signal: When the HMA turns downward from an uptrend.

- Dynamic Support and Resistance:

- The HMA acts as a support level in uptrends and resistance in downtrends. Utilizing Hull Moving Average in this way enhances your strategy.

Trading Strategies Using the HMA Indicator

1. Trend Following Strategy

- Buy when HMA turns bullish and price remains above the HMA.

- Sell when HMA turns bearish and price remains below the HMA. This effective Hull Moving Average technique ensures you follow the trend.

2. HMA Crossover Strategy

- Use two HMA indicators (fast and slow periods).

- Buy signal: When the fast HMA crosses above the slow HMA.

- Sell signal: When the fast HMA crosses below the slow HMA.

3. HMA with RSI Confirmation

- Buy when HMA turns bullish and RSI is above 50.

- Sell when HMA turns bearish and RSI is below 50. Combining Hull Moving Average with RSI can improve your trading signals.

Example of an HMA Trade

- A stock is in an uptrend, and the HMA turns upward after a pullback.

- The trader enters a long position when price bounces off the HMA.

- The stock continues to rally, confirming the bullish trend using the Hull Moving Average.

Advantages of Using the HMA Indicator

- Reduces Lag: Faster response to price changes than SMA and EMA.

- Provides Smooth Trend Signals: Less noise in choppy markets thanks to the Hull Moving Average.

- Works Well with Other Indicators: Pairs well with RSI, MACD, and Fibonacci retracements.

Limitations

- Not Ideal for Sideways Markets: May generate false signals in ranging conditions.

- Requires Optimization: Choosing the right period length is key for accuracy, especially when using the Hull Moving Average.

Conclusion

The HMA Indicator is a valuable tool for trend analysis, entry/exit signals, and dynamic support/resistance levels. When combined with momentum indicators, it improves trade accuracy and decision-making, making Hull Moving Average a must-have in any trader’s toolkit.