BOP Indicator: Measuring Buying and Selling Pressure

Introduction

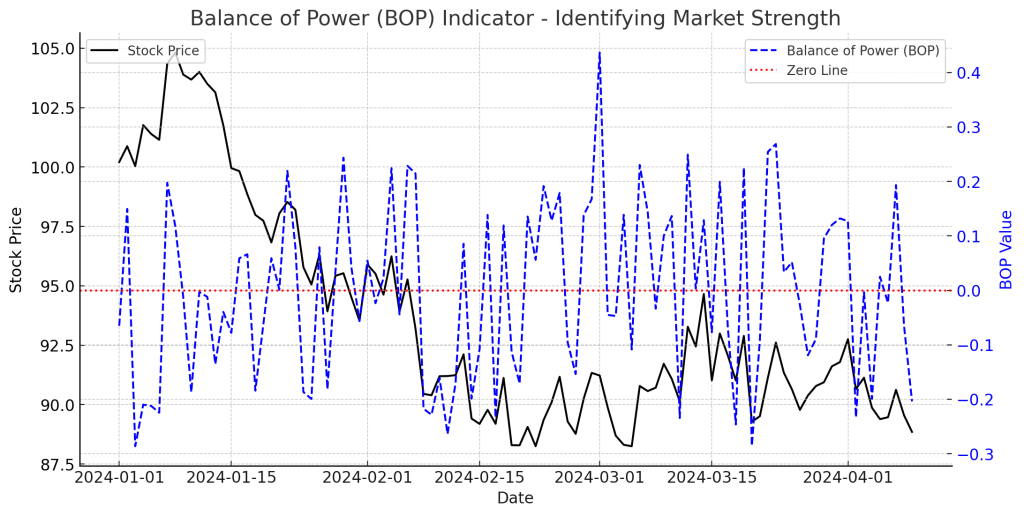

The Balance of Power (BOP) Indicator is a technical tool that helps traders evaluate the strength of buyers versus sellers. Developed by Igor Livshin, BOP is used to assess market momentum and trend reversals.

What is the BOP Indicator?

The BOP Indicator measures the power struggle between buyers and sellers over a given period. It ranges between -1 and +1, where:

- Above 0: Buying pressure is dominant (bullish signal).

- Below 0: Selling pressure is dominant (bearish signal).

- Near 0: Market is in equilibrium (neutral zone).

How the BOP Indicator Works

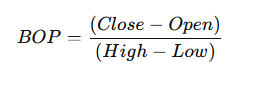

BOP is calculated using the formula: BOP=(Close−Open)(High−Low)BOP = \frac{(Close – Open)}{(High – Low)}

Where:

- Close – Open: Measures price movement within the period.

- High – Low: Represents total range of price fluctuations.

- BOP values are often smoothed with a moving average to reduce noise.

How to Use the BOP Indicator in Trading

1. Identifying Trend Strength

- BOP consistently above 0 → Strong bullish trend.

- BOP consistently below 0 → Strong bearish trend.

- Fluctuating BOP near zero → Indecision or sideways market.

2. Spotting Reversals

- Divergence between BOP and price signals a potential reversal.

- Example: Price makes a new high, but BOP declines → Bearish divergence.

3. Confirmation with Other Indicators

- Use BOP with RSI or MACD to confirm trend strength.

- Combine BOP with moving averages for smoother trade signals.

Example of a BOP Trade

- A stock is trading in an uptrend, and BOP is consistently above 0.

- Price approaches a resistance level, but BOP starts declining.

- The trader exits the long position, anticipating a reversal.

Advantages of the BOP Indicator

- Early Trend Reversal Signals: Helps traders exit before a trend shifts.

- Works Across Markets: Useful for stocks, forex, and crypto trading.

- Enhances Risk Management: Helps avoid weak trend entries.

Limitations

- Requires Smoothing: Works best with a moving average.

- False Signals in Low-Volume Markets: Needs confirmation with other indicators.

Conclusion

The BOP Indicator is a valuable tool for understanding market sentiment and trend reversals. When used alongside technical indicators like RSI and MACD, BOP can improve trade accuracy and risk management.