RSI Formula: How to Calculate the Relative Strength Index

Introduction

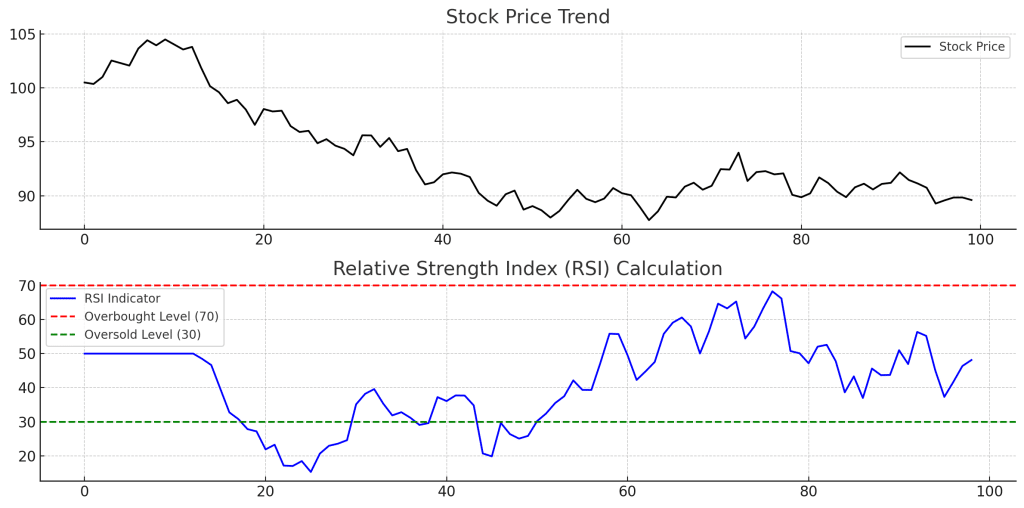

The Relative Strength Index (RSI) is a momentum oscillator used in technical analysis to measure the strength of price movements. Understanding the RSI Formula helps traders identify overbought and oversold conditions in a stock or asset, making it a valuable tool for market timing.

RSI Formula

The RSI is calculated using the following formula:

RSI=100−1001+RSRSI = 100 – \frac{100}{1 + RS}

Where RS (Relative Strength) is calculated as:

RS=AverageGainovernperiodsAverageLossovernperiodsRS = \frac{Average Gain over n periods}{Average Loss over n periods}. This forms the basis of the RSI Formula.

- The default period for RSI is 14 days, but traders can adjust it for different timeframes.

- The values range from 0 to 100, with key levels at 30 (oversold) and 70 (overbought).

Step-by-Step RSI Calculation

- Calculate the daily price changes (positive = gain, negative = loss).

- Compute the average gain and average loss over the chosen period. This step is crucial for the RSI Formula.

- Divide the average gain by the average loss to get RS.

- Apply the RSI formula to compute the final RSI value.

How to Interpret RSI

- RSI above 70: Overbought condition – a potential sell signal.

- RSI below 30: Oversold condition – a potential buy signal according to the RSI Formula.

- RSI between 50-70: Indicates strong bullish momentum.

- RSI between 30-50: Suggests bearish momentum.

Example of RSI in Trading

A trader might:

- Enter a buy trade when RSI moves above 30, confirming upward momentum.

- Enter a sell trade when RSI falls below 70, indicating weakening strength.

- Look for RSI divergences, where price and RSI move in opposite directions, signaling trend reversals. Traders often rely on the RSI Formula for such analyses.

Advantages of RSI

- Easy to Use: Simple to calculate and interpret thanks to the clear RSI Formula.

- Works Across Different Markets: Useful in stocks, forex, and cryptocurrency trading.

- Combines Well with Other Indicators: Often paired with MACD, Moving Averages, and Bollinger Bands.

Limitations

- False Signals: RSI can remain overbought or oversold for long periods in strong trends.

- Should Be Used with Confirmation Tools: Combining RSI with volume analysis or trend indicators improves accuracy.

Conclusion

The RSI Formula is a powerful tool for traders looking to measure market momentum and identify potential entry and exit points. When used alongside trend indicators and support/resistance levels, RSI enhances trading strategies and improves decision-making.