Rising Wedge Stock Pattern: A Bearish Reversal Formation

Introduction

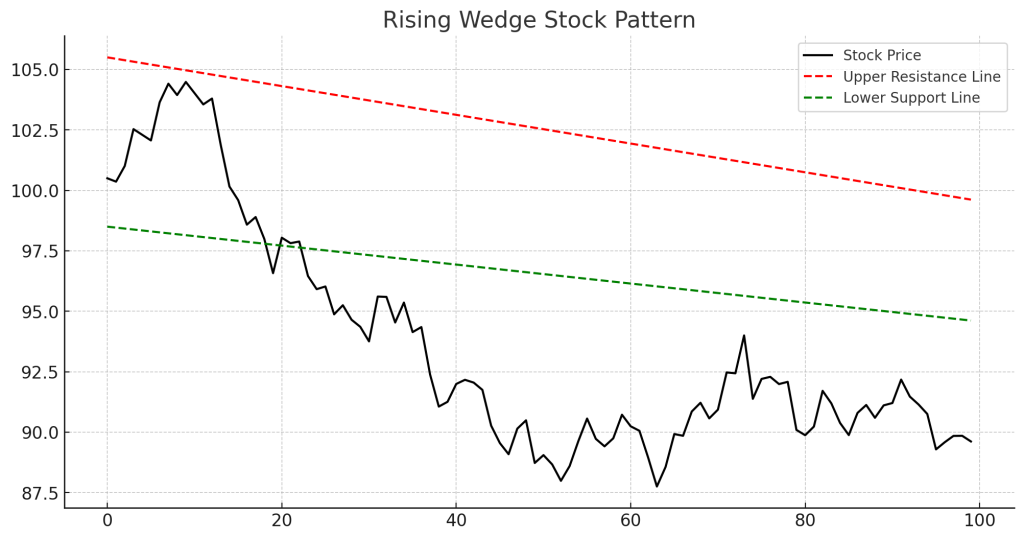

The Rising Wedge Stock Pattern is a bearish chart pattern that signals a potential downtrend reversal. It occurs when the stock price moves higher but within a narrowing range, showing weakening momentum.

Understanding the Rising Wedge Stock Pattern

A Rising Wedge forms when:

- The stock price makes higher highs and higher lows, but the range contracts.

- The resistance and support trendlines converge, forming an upward-sloping wedge.

- Decreasing volume indicates weakening buying pressure.

- A breakdown below the lower support trendline confirms the bearish pattern.

How to Identify a Rising Wedge Pattern

- Upward Sloping Trendlines: Connect the higher highs and higher lows.

- Narrowing Price Range: The price moves in a contracting wedge.

- Bearish Breakout: A price drop below the lower support line confirms the pattern.

- Divergence on RSI or MACD: Weakening momentum often accompanies the pattern.

Trading Strategies Using the Rising Wedge

A trader might:

- Enter a short position after a breakdown below the support line.

- Set a stop-loss just above the latest high to manage risk.

- Target a decline equal to the height of the wedge from the breakdown point.

Example of Rising Wedge Stock Trading

- Suppose a stock trends upward but starts forming a contracting range.

- If the price breaks below the support level with increased volume, it signals a bearish move.

- A trader enters a short position, expecting a downtrend.

Advantages of the Rising Wedge Pattern

- Early Warning of a Reversal: Helps traders exit long positions before a drop.

- Well-Defined Entry and Exit Points: Stop-loss and target levels are clear.

- Works in Stocks, Forex, and Crypto: A reliable pattern across different markets.

Limitations

- False Breakouts: Sometimes, price may break upward instead.

- Needs Confirmation: RSI, MACD, or volume analysis improves accuracy.

Conclusion

The Rising Wedge Stock Pattern is a key bearish reversal indicator that warns of an impending downtrend. When combined with trend confirmation tools and volume analysis, traders can improve their success rate in identifying profitable trade setups.