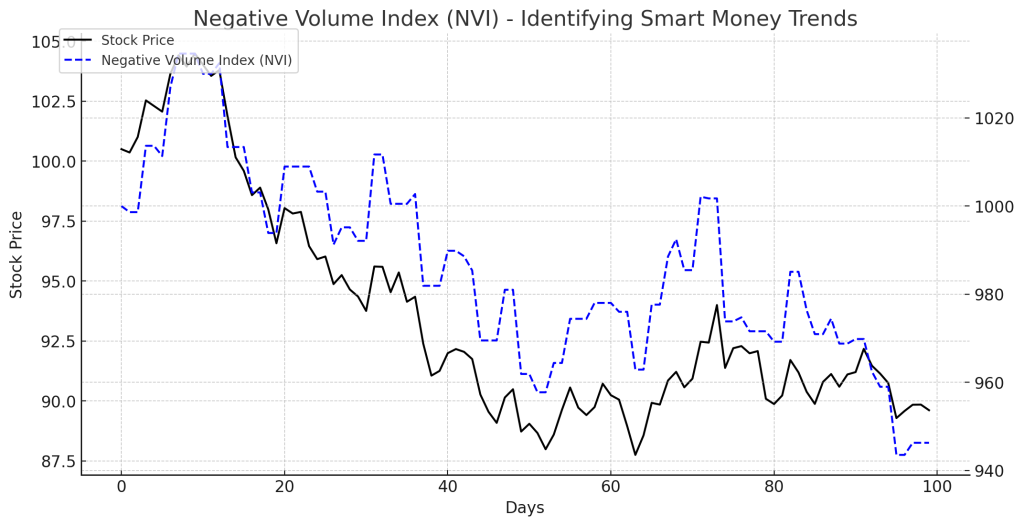

Negative Volume Index (NVI): Identifying Smart Money Trends

Introduction

The Negative Volume Index (NVI) is a technical analysis tool that helps traders track price movements when trading volume decreases. It is based on the idea that smart money (institutional investors) operates in lower-volume conditions, while retail traders dominate high-volume days.

What is the NVI ?

The NVI focuses only on days when volume declines, assuming that significant price changes on low-volume days are influenced by institutional investors, which aligns with the essence of the NVI

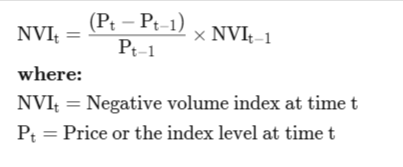

Formula for Negative Volume Index (NVI):

If today’s volume is lower than the previous day’s volume:

Otherwise:

How to Interpret the NVI

- Uptrend Confirmation:

- If NVI rises alongside price, institutional money is supporting the trend, confirming the principles of the Negative Volume Index.

- Suggests a bullish confirmation.

- Bearish Warning:

- If price rises but NVI remains flat or declines, the uptrend may lack smart money support.

- Could signal a potential market reversal.

- Divergence Signals:

- Bullish Divergence: Price is declining, but NVI is rising – suggests accumulation by institutions.

- Bearish Divergence: Price is rising, but NVI is flat or falling – suggests distribution by institutions.

Trading Strategies Using NVI

1. Trend Confirmation Strategy

- If NVI is increasing, stay in long positions.

- If NVI declines while price rises, consider reducing exposure.

2. Divergence Trading

- If price falls but NVI remains stable or rises, institutions may be accumulating shares as suggested by the Negative Volume Index.

- If price rises but NVI is flat or declining, institutions may be exiting positions.

3. Combining NVI with Moving Averages

- Use the 255-day Moving Average of NVI:

- If NVI is above its 255-day MA, bullish confirmation.

- If NVI is below its 255-day MA, bearish confirmation.

Example of an NVI Trade

- A stock’s price has been rising, but NVI remains flat.

- This suggests the rally is driven by retail traders rather than institutions as tracked by the Negative Volume Index.

- The trader prepares for a potential price correction or reversal.

Advantages of Using NVI

- Detects Institutional Money Flow: Helps track smart money activity.

- Enhances Trend Confirmation: Confirms whether trends are strong or weak as the Negative Volume Index helps distinguish.

- Filters Noise from Volume Spikes: Ignores high-volume retail-driven price swings.

Limitations

- Not Useful in High-Volume Markets: NVI does not react to strong volume days.

- Best Used with Other Indicators: Works best alongside Moving Averages, OBV, or RSI to complement the Negative Volume Index.

Conclusion

The Negative Volume Index (NVI) is a powerful tool for identifying institutional money flow and trend strength. By analyzing NVI alongside price action and moving averages, traders can improve decision-making and risk management.