Gap Stocks: Understanding Price Gaps and Trading Opportunities

Introduction

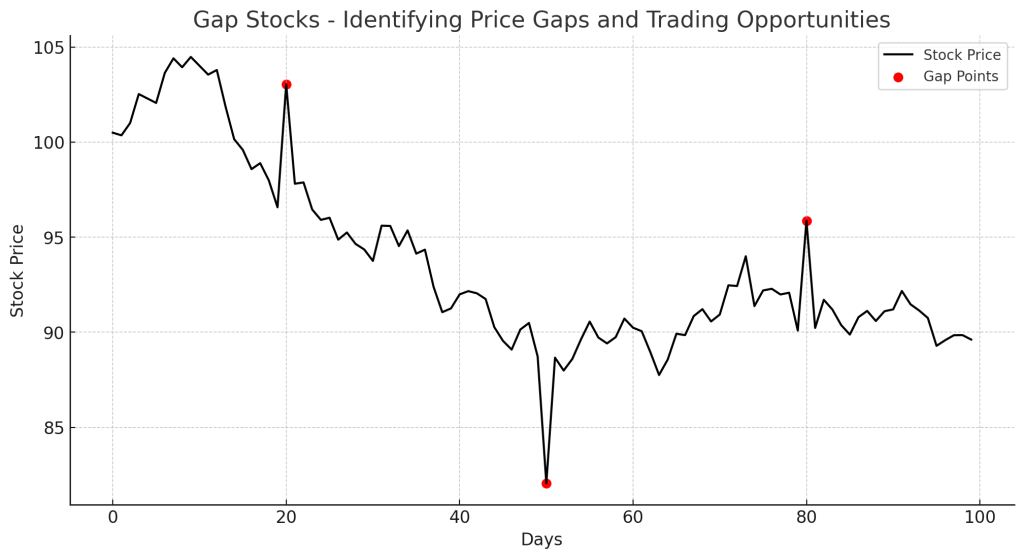

Gap stocks are stocks that experience a price gap between two trading sessions, where the stock opens significantly higher or lower than the previous closing price. These gaps can indicate strong market sentiment and present profitable trading opportunities.

What are Gap Stocks?

Gap stocks refer to stocks that experience price gaps due to sudden shifts in buying or selling pressure. Gaps occur when there is a significant difference between the closing price of one trading session and the opening price of the next session. Understanding price gaps and trading them effectively can be very rewarding.

Types of Gaps in Stock Trading

1. Common Gap

- A small price gap that occurs in low volatility stocks.

- Usually fills quickly and has no significant long-term impact.

2. Breakaway Gap

- Occurs at the start of a new trend and signals strong momentum. Effective trading by identifying such price gaps can be beneficial.

- Often seen after major news events or earnings reports.

3. Runaway (Continuation) Gap

- Occurs in the middle of a strong uptrend or downtrend.

- Signals trend continuation with strong volume.

4. Exhaustion Gap

- Happens at the end of a trend and signals trend reversal.

- Volume spikes, followed by price pullback or reversal. Recognizing these price gaps is crucial for successful trading.

How to Identify and Trade Gap Stocks

1. Identify the Type of Gap

- Check pre-market and after-hours trading for potential gaps.

- Use volume analysis to determine if the gap is strong enough to sustain movement for the best gap and trading results.

2. Gap Trading Strategies

A. Gap and Go Strategy (Momentum Trading)

- Buy when a gap up occurs on high volume and price breaks above resistance.

- Short-sell when a gap down occurs with strong bearish momentum

B. Gap Fill Strategy

- Some gaps tend to fill (close the price difference) over time.

- Buy when the price returns to a gap support level.

- Sell when the price returns to a gap resistance level.

C. News-Driven Gap Trading

- Trade gaps caused by earnings reports, economic data, or breaking news for effective price gaps and trading results.

- Confirm gaps with RSI, MACD, or Moving Averages.

Example of a Gap Stock Trade

- A stock closes at $100, but due to strong earnings, it opens at $110 the next day (gap up).

- The trader buys at $111 as price breaks above pre-market highs.

- The stock rallies to $120, and the trader exits for a profit. Successful price gaps and trading can lead to significant gains.

Advantages of Trading Gap Stocks

- High Profit Potential: Gaps often lead to strong price movement.

- Clear Entry & Exit Points: Defined support/resistance levels.

- Works Across Multiple Markets: Applies to stocks, forex, and crypto. Efficient price gaps and trading strategies can be utilized in various markets.

Limitations

- False Breakouts Can Occur: Requires volume confirmation.

- Market Sentiment Can Change Quickly: Stops should be placed to manage risk. Being aware of price gaps and trading limitations helps in risk management.

Conclusion

Gap stocks provide exciting trading opportunities for short-term traders looking to capitalize on price gaps. By understanding gap types, volume confirmation, and technical indicators, traders can increase their success rate in gap trading.